Attorney general: ambulance tax vote ‘substantially complied’ with law

Published 3:32 pm Thursday, May 4, 2017

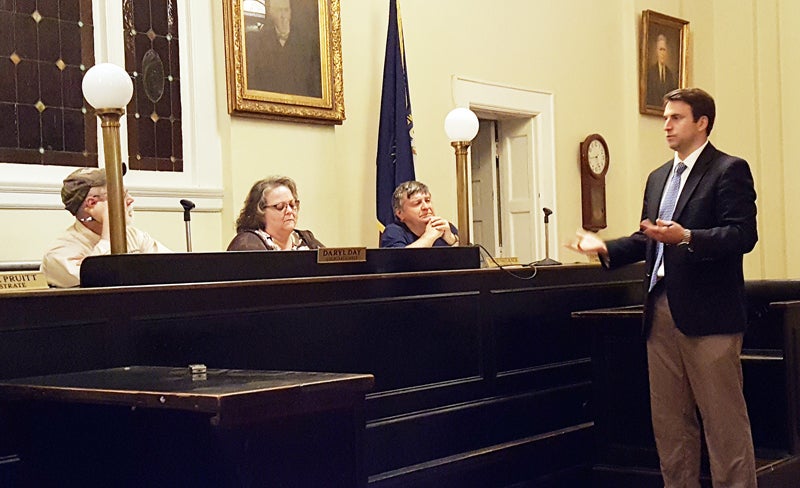

- File Photo By Abigail Whitehouse

STANFORD – After several months of uncertainty, the Lincoln County Ambulance Board can now move forward distributing tax revenue after an opinion from the attorney general ruled the board’s vote “substantially complied” with state law.

Last August, the Lincoln County Ambulance Board voted to increase real and personal property tax rates from 4.8 cents per $100 of assessed value to 9.8 cents per $100. The new tax rates are estimated to generate a total of $899,653 in revenue.

Since the vote, concerns over the legality of the vote were raised by a Lincoln County resident regarding the timing of which the board agreed to address. The resident argued that the vote was illegal because it didn’t allow for the full 45 day petition period, the public hearing was held five days following the second advertisement while the law states it must be held no less than seven days and no more than 10 days following the advertisement, and that one of the two required newspaper advertisements was not 12 column inches.

In February, the board hired Assistant Commonwealth’s Attorney Neal Tucker as legal counsel and instructed him to send a letter to the attorney general requesting an opinion on the legality of the August tax vote.

The opinion, written by Assistant Attorney General Matt James, was released on April 28 and permits the board to continue with distributing the revenue from the tax.

“We advise that the Ambulance board substantially complied with the requirements of KRS 132.023, even though the second notice was published five days before the public hearing instead of the required seven days, and the ambulance board is not prohibited from distributing the revenue from the tax on those grounds,” the opinion states.

The ambulance board published two notices in The Interior Journal, one on July 28 and another on Aug. 4. The public hearing was held on Aug. 9, five days after the second advertisement.

The attorney general’s opinion on the tax vote hinges on two terms, “directory” and “mandatory” and cites the legal case Hardin v. Montgomery (2016), which states “If a statue simply provides that certain acts or thing shall be done within a particular time or in a particular manner, but does not declare or indicate that their performance is essential to the validity of the election, they will be regarded as directory if they do not affect the actual merits of the election.”

“Courts will apply substantial compliance when a statutory provision is directory rather than mandatory,” the opinion states. “This determination is crucial because a ‘proceeding not following a mandatory provision of a statute is rendered illegal and void, while an omission to observe or failure to conform to a directory provision is not.”

Citing a 1947 legal case Hall v Sturgill, the attorney general argues the “publication of notices of an election is mandatory, but that provisions concerning the time of the publication are directory, and that substantial compliance with them is sufficient.”

“Although the ambulance board did not strictly comply with KRS 132.023 (2) (b) (6), the mandatory notices were published,” the opinion states.

The attorney general argues that since 23 people showed up to the public hearing, that indicates the public was generally aware of the proposed tax increase.

“Under these circumstances, we advice the ambulance board’s failure to strictly comply with KRS 132.023 (2) (b) (6) does not prohibit it from distributing revenue collected from the tax.

Concerning the 45-day petition period that state law requires, the attorney general opinion argues that an election is only necessary if a petition is found to be sufficient, which means it must be signed by 10 percent of the voters in the area in the last presidential election.

A petition committee filed paperwork on Sept. 15 with hopes of gathering the 916 signatures to put the question to a vote but only had until 4 p.m. Sept. 26 to file a complete petition at the clerk’s office.

The deadline to file a petition at the Lincoln County Clerk’s Office was Sept. 26 – 45 days after the Lincoln County Ambulance Board voted to set the real and personal property tax rates for 2016-17.

“In this case, the required ten percent of the voters was not met, and the petition was not sufficient for a recall vote,” the attorney general states.