Ambulance board chairman, committee file petition to oppose property tax increase

Published 9:38 pm Thursday, September 22, 2016

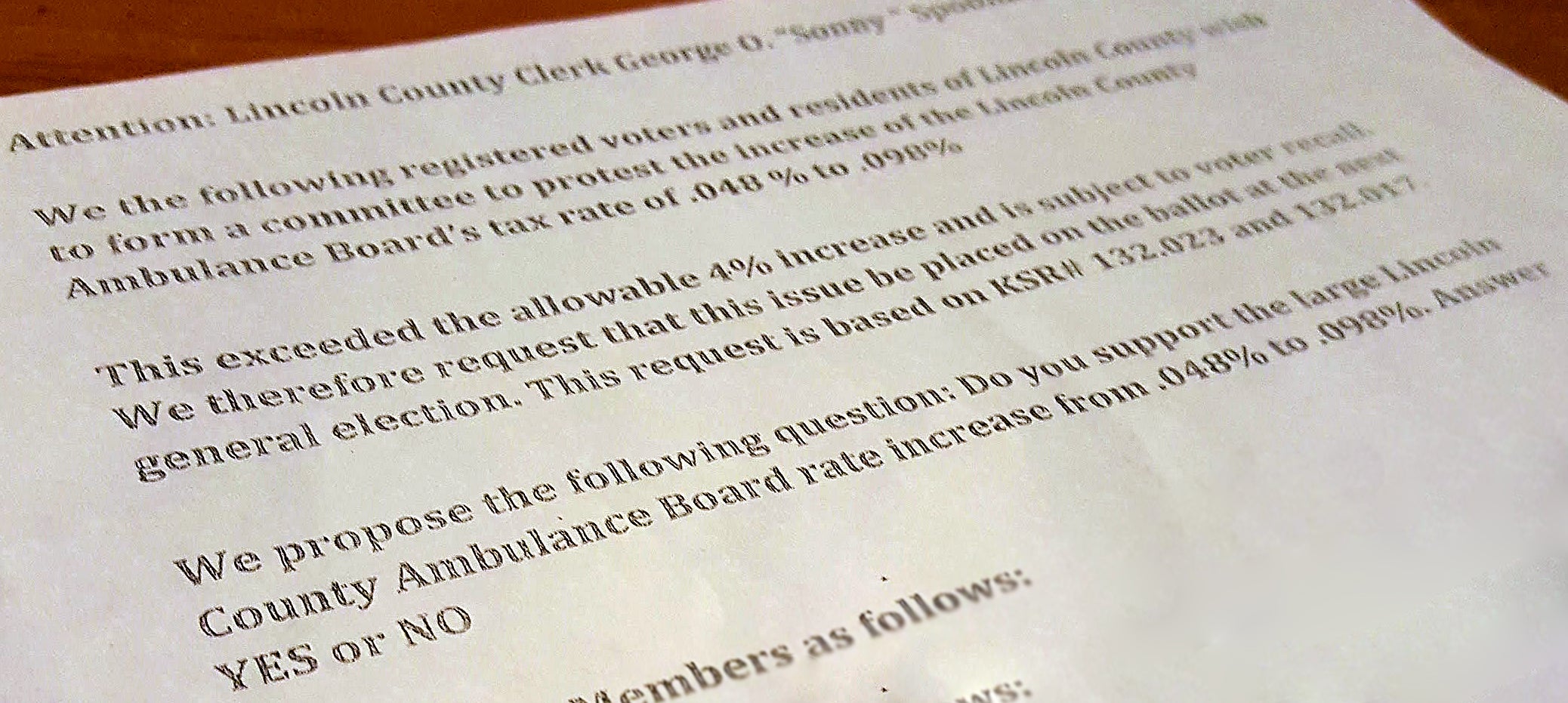

STANFORD – A petition calling for a voter recall of the tax rates set by the Lincoln County Ambulance Board is circulating and committee members are attempting to gather signatures of support.

The petition was filed in Lincoln County Clerk Sonny Spoonamore’s office Sept. 15 by Ambulance Board Chairman Jerry Shelton and includes the signatures of seven people who have agreed to form a committee to oversee the petition process.

The seven committee members are: Ernest L. Hopkins, Anna Mae Hopkins, Hal V. Oaks, Ray Sims, Jennifer M. Smith, Curtiss Wells and Jerry Shelton.

The 45-day window for those wishing to challenge the tax increase opened as of Aug. 11 following the board’s vote to raise real and personal property tax rates from 4.8 cents per $100 of assessed property value to 9.8 cents per $100 of value.

Since the tax rate will provide more than a 4-percent increase in property tax revenue, the board was required to advertise in the newspaper, hold a public hearing and wait the 45-day petition period before printing the tax bills.

The legality of the board’s action setting the 2016 tax rates has been in question since August when Lincoln County Property Valuation Administrator David Gambrel gave a powerpoint presentation on how to set rates according to Kentucky state law.

In Gambrel’s interpretation of the law, the rate would have had to have been set by June 24 in order to allow a 45-day period before the second Tuesday in August – which is the deadline to place the issue on the general election ballot this year.

Judge-Executive Jim Adams previously said he agrees that it is too late for the issue to be put on the ballot but he consulted with Kentucky Association of Counties (KACO) attorneys who said the board could still attempt to set the rate and later rescind the decision if a petition is successful.

The 45-day petition period ends on Sept. 26, Adams said, which leaves only 11 days for the petition committee to gather about 915 certifiable signatures and present the petition to Lincoln County Clerk Sonny Spoonamore to put the issue on the next general election ballot.

The discussion on setting the tax rate has been ongoing since May. At the beginning of the year, a consolidation committee comprised of the county’s three remaining ambulance services put together a proposal for consolidation and data detailing the dire funding situation the services currently face. Without a sizable tax increase, the consolidation committee told the ambulance board that the county’s ambulance services might not survive another five years if forced to operate on the current budget provided by tax dollars – about $400,000 annually.

After reviewing the data, board members agreed an increase was necessary but differed in opinions as far as when to set the rate. One board member, Billy Phillips, abstained from voting on the motion to set the rate because he believes if the board had voted in June like he and EMS officials urged them to, they wouldn’t be in the position they are today.

Shelton said publicly during the consolidation committee’s public forum that he would sign a petition opposing the increase if one came about – which it did last week.

While Adams is skeptical about the committee’s ability to gather that many signatures within the time period, Ambulance Board Chairman Jerry Shelton, who turned in the paperwork last Thursday, said he thinks they will be able to gather the necessary support.

“I’m pretty confident that we’ll get the signatures,” Shelton said.

Shelton said he and the committee find the tax increase to be “excessive” and wants the people of Lincoln County to decide. He said the committee will likely go door-to-door asking for those signatures.

“We are not elected officials,” Shelton said. “A tax increase of this magnitude should be put to the people.”

One person in particular voiced his opposition during the ambulance board’s regular meeting Monday night but his concerns were not necessarily with the tax increase as much as the legality of the process over the last month.

“Your tax levy is illegal and I want to know why you’re breaking the law,” Miller said. “According to the Attorney General it is illegal.”

Board member Bob Floro asked Miller to elaborate on his concerns.

Miller noted an error in the size of the required July 28 advertisement in The Interior Journal, which should have been 12-column inches according to state law.

He also said the board violated state law when they held the required public hearing on Aug. only five days after the publication of the second advertisement. Kentucky Revised Statutes state that the board must wait no less than seven days and no more than 10 days before holding the hearing.

Miller quoted other state statutes regarding the tax levy that he feels the board has violated while Floro took notes.

Floro made a motion for the board to seek counsel from County Attorney Daryl Day to address the issues brought up by Miller.

“If you’re correct, I don’t know what your next legal step would be,” Shelton said. “I would assume that’s up to you, would be my guess. I’m not an attorney but I think that you have a right to file something with the Lincoln County court.”

Shelton said as chairman he has to serve at the pleasure of the board, but it’s no secret that the board has gone in a different direction than he envisioned.

“If Mr. Day tells us something different than what you’re saying, the problem is we are still in a time constraint regardless of what’s happened,” he said.

Board member Ted Defosset said the board will look into all of Miller’s concerns and will have their findings ready for him by the next regular meeting.

“I will tell you there is a petition that will soon hopefully have enough names on it to put this into the next general election,” Shelton said. “That was filed this week. The petition is an action of the people, not the board.”